INTRODUCTION

The Malaysian Inland Revenue Board (“MIRB”) is expected to issue an update to the Malaysian Transfer Pricing Guidelines and the TP Audit Framework any day now.

This is to incorporate changes brought about effective 1 January 2021 which introduce penalties for failure to submit transfer pricing documentation within 14 days of a request by the IRB and the imposition of a surcharge on all transfer pricing adjustments in Malaysia. [1]

The issuance of the Transfer Pricing Documentation (“TPD”) Flowchart and Self-test questionnaire by the MIRB on 20 September 2021 (updated 2 December 2021) [2] is to be lauded as it is indeed a step in the right direction to provide further clarification to taxpayers (particularly local Groups) as to the circumstances in which they should be preparing TPD.

The TPD Flowchart and Self-test enable taxpayers to determine whether they are required to prepare TPD. However it is important for taxpayers to bear in mind that that the preparation of TPD is not the end all – in fact it is just the first line of defence and what is required in all circumstances is good quality robust TPD. TP audits are here to stay and taxpayers who have undergone this will admit that this is indeed a challenging journey.

When TP audits were first introduced in Malaysia in 2004, the additional assessments and penalties issued by the MIRB were in excess of RM20million but this amount ballooned to RM600 million in 2018. As observed by the MIRB, this number indeed calls into question the level of compliance by taxpayers in Malaysia.

INCREASED TRANSFER PRICING AUDIT ACTIVITY

BDO Tax foresaw a sharp spike in TP audit activity in 2021 and this has indeed been the case. This trend is expected to carry through to 2022 as the economy gradually recovers from the ravages of COVID-19.

In view of the increasing scrutiny by the MIRB, taxpayers should assess their risk profiles and the adequacy of their documentation in preparation for an audit.

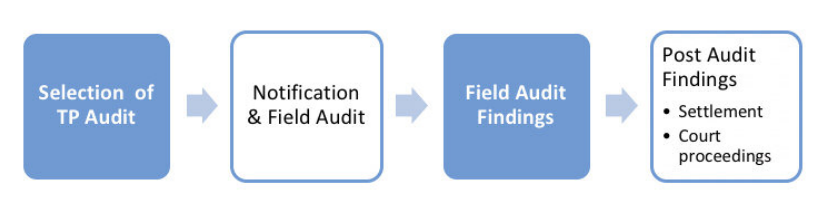

The audit process may broadly be depicted in Figure 1 below:

Figure 1: TP Audit process

Selection for a Transfer Pricing Audit

Taxpayers in Malaysia are required to provide very comprehensive information on related party transactions in the income tax return (Form C). The MIRB will select taxpayers for audit based on these information disclosures.

Some of the indicators for selection for an audit include companies with high levels of related party transactions, low profit margins or continuous losses or which record a sharp decrease in profitability after a tax holiday.

The audit

Taxpayers will be requested to submit extensive information from the general ledger to etc as well as TPD within 14 days of a request by the MIRB. This will typically be followed by a notification of commencement of audit which would involve a presentation by the taxpayer and a functional analysis interview by the MIRB. The MIRB has adapted quickly to the new normal with TP audits on taxpayers being done virtually.

This would typically be followed by a request for more information by the MIRB and the issuance of a tax audit findings letter.

Field Audit Findings

Taxpayers are given 18 days to respond to the IRB’s audit findings letter. Issues may range from traditional issues on the purchase and sale of goods, intragroup services, intangibles, business restructuring to intragroup financing.

Interest-free Advances

An area which has received particular scrutiny in 2021 is that of intragroup financing, in particular interest-free intercompany advances.

Many holding companies have given interest-free advances to their subsidiaries both within Malaysia and outside Malaysia and have been subject to transfer pricing adjustments on these advances. The question of whether these advances can be seen as contributions to equity capital (quasi-equity) on which no interest payments are due as opposed to a loan depends very much on the facts and circumstances of each case.

Some of the indicators to be considered are features of the payment such as:

- Is there a fixed term of repayment?

- Duration of the advance (i.e. short term or long term).

- Security provided in respect of the advance.

- Is repayment dependent on the borrower’s performance?

Ultimately the ability of a taxpayer to defend an interest-free advance hinges on its documentation trail and it is important that the taxpayer’s intention be documented from time that the advance was first given e.g. board minutes, etc.

Adjustment to the Median

The MIRB has long taken the position that taxpayers should earn at least a median return for them to prove that their transactions are at arm’s length.

However, in the landmark decision on transfer pricing of S v Ketua Pengarah Hasil Dalam Negeri, the Special Commissioners unanimously agreed with the taxpayer’s position that if the price or margin of the taxpayer falls within the arm’s length interquartile range, when this is used, no adjustments to the median is required. Reliance was placed on the OECD TP Guidelines 2017 (Paragraph 3.60 and 3.62) in support of this stand.

This case establishes that whilst the IRB’s powers are set out in Section 140A of the Income Tax Act 1967 and the Income Tax (Transfer Pricing) Rules 2012 with further guidance being provided via the Malaysian Transfer Pricing Guidelines, the internationally recognised OECD TP Guidelines still remain the “gold standard” for guidance on TP matters in Malaysia.

TP audits have come a long way since the first audits began in 2004. Audit findings are very comprehensive and arguments are increasingly technical. With that taxpayers need to ensure that they are well prepared. It is crucial that taxpayers maintain sufficient documentation which supports their transfer pricing positions.

CONCLUSION

As the TP landscape continues to evolve in Malaysia, taxpayers should not fear an audit. In our experience, it is indeed possible to survive a TP audit without any adjustment.

The preparation of TPD together with intercompany agreements and other relevant documentation as well as the yearly review of TP policies will put taxpayers in the best position to defend their transfer prices during an audit.

Sources:

[1] Updated Malaysian Transfer Pricing Guidelines 2012

[2]https://phl.hasil.gov.my/pdf/pdfam/Transfer_Pricing_Documentation_TPD_Flowchart.pdf